Tokenomics

Allocation

120M MST tokens with defined percentages for Public Sale, Seed Round, Treasury, Strategic Partners, Founders, and Community Rewards.

Utility

Staking, exclusive project access, liquidity, diversification.

Revenue Flows

Equity sales, royalties, token demand growth

Vesting

Founder & Team tokens vest over 4 years with 1-year cliff; Seed tokens vest over 18 months.

How It works

Buy MST

Tokens

Purchase MST directly during our token sale

Treasury

Deployment

Funds are allocated to a diversified portfolio of

Smart Contract

Governance

Each funding agreement is encoded into blockchain

Project Milestones

Achieved

As mining projects hit key goals value flows back

Token Holder

Benefits

Token holders gain value through price appreciation

Buy MST

Tokens

Purchase MST directly during our token sale

Treasury

Deployment

Funds are allocated to a diversified portfolio of

Smart Contract

Governance

Each funding agreement is encoded into blockchain

Project Milestones

Achieved

As mining projects hit key goals value flows back

Token Holder

Benefits

Token holders gain value through price appreciation

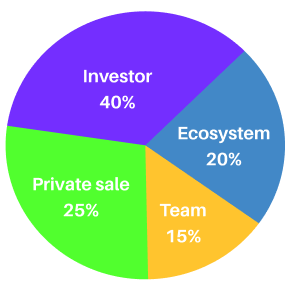

Token Distribution

Community & Ecosystem Growth

Team & Advisors

Staking Rewards:

Liquidity & Exchanges

Reserve or Treasury

Join the Mining Finance Revolution Today.

Utility & Benefits

Utility

Access to mining deals, governance votes, and early project rounds

Deflation

Token burns tied to project milestones reduce total supply

Rewards

Staking programs for long-term holders and supporters

Real World Link

Token value connected to actual metals and project success